The Risks and Benefits of Socializing with Suppliers

I had a chance to meet with a group of supply chain executives at the University of Calgary this week, which included a discussion by Ken Rawson. Ken has over 30 years of experience working in supply management, first with CP Railroads, and then with Suncor Energy.

He raised the issue of how gifts from suppliers can get in the way of relationships. While socialization is certainly an important part of buyer-seller relationships, the issue of whether it influences one’s decision comes up. Ken recalled the discussion he had with an operations field technician, who was wearing “swag” from his different suppliers. When asked about it, his response was – “if I took off all the stuff suppliers gave me, I’d be sitting here naked!”

Suppliers are quick to invite buyers to social events: hockey games, fishing trips, golfing events, rock concerts, and multiple other types of gifts. But the question always comes up: How would the board of the buying company view this activity? Would attending these events ever influence the outcome of the buying manager’s decision to source fairly without bias? And what is the cost of these events and gifts? $500, $1000, or $10,000+? The supplier is paying for these gifts. Do they expect something in return? And what is that expectation?

If a buyer is careful in providing key evaluation criteria, and opens up transparency on pricing, and establishes the right conditions in the contract, then social events shouldn’t influence the decision, right? But the question will always come up whether undue influence can occur. In some cases, the conflict of interest is obvious, such as the case of two construction suppliers paying over $1 million for sidewalk and emergency snow clearing contracts for the city of Atlanta to procurement officials.

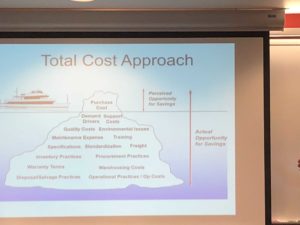

There are some benefits to socialization. You might see the seller more often if they are local, and they may be more likely to go out of their way to support you as a customer if there is an emergency. And there are always many other elements to consider other than price. Other criteria that may also come up and be negotiated through improved supplier relationships include many of the elements of total cost that go beyond price (see Figure below).

A big opportunity is specifications. On a major plant turnaround, there are multiple components and parts that are replaced. One of the items on the turnaround replaced was an expensive part that the specification stated needed to have a 20 year life. Yet the part was replaced every 3 years when a turnaround took place! Opportunities such as these may be brought to a buyer’s attention by a supplier who has a good relationship with the buying company.

On the other hand, suppliers will do anything they can to influence the decision. Ken discussed a situation when two suppliers of pumps both wanted 100% of the business for Suncor Energy. There was the desire to one day switch to one supplier, but during Ken’s time, that did not happen: “Suncor were still using both pump suppliers, the last that I heard.” This does not change the whole idea though of one day achieving 100% success with just one supplier. In the end, one of the suppliers had a product that was much more reliable, the company was leaning towards moving all the business to the one supplier, based on performance, and not on the “social benefits” that accrued. The point here is that socialization can help improve the relationship, but should not and cannot be used to justify the outcome of the commercial contract that emerges.

Ken gave another example of rail anchors, a part that is put on either side of the tie on a railroad, especially around crossings. The anchor digs into the tie and physically holds the rail and prevents it from moving. The supplier had been doing business with CP Rail for 80 years. It is simply a hunk of metal, put into a mechanical form, and bent. The question that always came up was the price for the anchor. The procurement team began to develop an index which included a Stats Canada index for material, a local energy index for Quebec (where the supplier was located), and a Consumer Price index for labor to track the cost of the anchor. And the formula was used to build a negotiating framework for discussion with the supplier. A similar approach was also applied to the cost of rail as well as the anchor. This moved the discussion away from “we’ve always done business”, to a more objective commercial relationship on pricing related to what was actually happening in the supply market. Ken notes that “after the index was put in place, the annual negotiation took literally 5 minutes to complete. And the rest of the discussion involved how to improve all of the other costs that existed in the lower section of the iceberg.”

Ken concluded that “the relationship will only go so far – and that it needs to be tempered with reality of the market. Suppliers should not be able to push through their entire costs from the market based on the relationship, but should be willing to share the cost with customers. Regardless of the relationship.”