The reality of green energy: “green metal” supply chains won’t be able to keep up

A recent set of investigations by the Economist provides a realistic view of the likelihood of a smooth transition to a green energy economy. Big Picture Up Front: it won’t be easy, and many of the current projections we are hearing about likely won’t be possible.

Environmentalists and automotive companies have committed to converting all of their vehicles to electric power. GM has committed to 30 new electric vehicles by 2025. Ford is committing to an all-electric vehicle platform with zero emissions by 2035. But nobody is talking about the supply chain for these vehicles, and the capacity required to build them. Converting an entire supply base of automotive suppliers, who are all focused on building of combustion engine-powered vehicles, and moving them all to electric vehicles, will be a superhuman feat. What will happen to those manufacturers that can’t or won’t convert? They go out of business? And is there enough capacity to produce the new types of vehicles? And what raw materials are required to convert to EV in the future?

The same question comes up for clean energy. The international Energy Agency predicts that wind and solar could account for 70% of power generation by 2050, up from 9% in 2020, if the world seeks to become carbon neutral by 2050. But that will also mean massive levels of demand for the metals required for green energy, such as cobalt, copper and nickel, that are vital for the technologies to build electric cars and renewables. The IEA predicts about a seven fold increase of such “green metals” by 2030. But where are the deposits of these “green metals”? And how will we mine them?

The Economist article provides some clues regarding the green metal supply chain and its capability to produce enough of the commodities required to power the electric conversion. This time the transition will bring windfalls to countries dubbed the “green-commodity superpowers”. The authors constructed a simple scenario for the use of ten “energy-linked” commodities in 2040, assuming that global warming by 2100 stays below 2 degrees C. The authors then used industry sources to project demand and revenue for thee fossil fuels (oil, gas, coal) vs. seven “green” metals (aluminum, cobalt, copper, lithium, nickel, silver and zinc) that are critical to building an energy economy. They assumed that prices remain at today’s elevated levels, and that miners would therefore exploit untapped deposits.

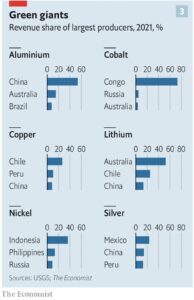

The findings suggest that the world will be less reliant on energy-related resources in 2040 than it is today. And there are a few winners and losers from this scenario. The winners are the electrostates: first Australia which has all of the metals in the green seven; Second Chile (which has 42%. of the lithium reserves and a quarter of its copper deposit, much in the Atacama desert – see picture of the flats above); Third, the Congo which has 46% of global cobalt reserves and produces 70% of the world’s output. Congo is an autocracy, but so is #4 on the list: China, which is home to aluminum, copper and lithium, while Indonesia sits on mountains of nickel, and Peru holds nearly a quarter of the world’s silver. The summaries of current revenue shares of these countries are shown below. The losers? Oil producing countries that may see their markets start to shrink…maybe..

But to be able to mine the volumes needed from these emerging regions to the levels that will create an electricity economy will require massive volumes of capital investment – much of which is not “green”, and which takes an awfully long time to develop. The IEA estimates that major mines that came online in the past decade took 16 years to build. And the industry will need to spend at least $2trn on green-metal exploration by 2040, according the Wood MacKenzie. Copper and nickel would require $250-300bn in capex before 2030. And guess who is doing the majority of this investment right now? You guessed it – China – which has nabbed the biggest commercial deposits of cobalt in the Congo. And capex is also limiting in mining, because the returns take so long to come by – in many cases more than two decades for the same return as four years of typical oil and gas capex. The figure below shows the revenue share of the largest producers in 2021 for these green metals. Unlike Western investors, Chinese don’t mind long periods of return on capex – they have a long-term view of the world.

Another big problem is the worsening quality of mineral deposits, as the grades of Chilean copper has fallen, and this in turn pushes up extraction and processing costs, which also pushes up carbon emissions! One expert noted that we use 16 times more energy to make the same pound of copper as we did 100 years ago.

Another big problem is the worsening quality of mineral deposits, as the grades of Chilean copper has fallen, and this in turn pushes up extraction and processing costs, which also pushes up carbon emissions! One expert noted that we use 16 times more energy to make the same pound of copper as we did 100 years ago.

Value analysis is another possibility. Innovation may find new substitutes or reduced requirements for these minerals. For example, Tesla’s batteries include less than 5%. cobalt, down from 30%. a few years ago. Extracting cobalt from old batteries through recycling could meet 12% of total demand – most electrical batteries need to be replaced within 10-15 years.

One of the biggest risks to investment is the political chaos that emerges when a poor economy becomes rich overnight. Countries such as Nigeria have undergone turmoil after oil was discovered. Many of these poor electrostates are now well equipped to manage the windfalls, and it is not clear how their sudden riches will be transferred to permanent economic benefits.

There are other risks as well: logistics in these regions (especially Africa and Chile). Another article in the same edition of the Economist suggests that there are significant bottlenecks in Africa at bridges crossing rivers and other problems such as corruption to gain access to roads. Add on the effects of poor infrastructure that limits rail networks, vehicle routes, and a lack of efficient ports for ocean cargo, and extracting and shipping minerals becomes a real problem! Road density in Africa is among the world’s lowest, and only 800,000 km of the 2.8M Sub-Saharan African desert has a paved road going across it.

Again, this will require investment in infrastructure, by improving how existing pipelines can be unblocked. If Africa’s logistics simply rose to the global average, it would boost flows by 12%. There are also inherent problems with the infrastructure in Africa, with a very fragmented logistics provider base, and a lack of “backhaul” capacity between destinations doing the buying and selling. So by extension, this will make the logistics of taking cobalt out of the Congo difficult.

All of these factors will combine to render the transition to the “electric economy” very challenging. We need to be thinking about the long-term design and development of supply chains that will support the movement to these emerging technologies of battery-powered vehicles, solar, wind, and water power. It is one thing to be all for sustainability – but we also need to deal with the realities of what it really means to move to this approach. It is unlikely we will move as quickly as governments and companies are projecting – the obstacles are just too great. Which means we will be living with petroleum-based technologies for some time to come. Don’t sell your pick up just yet.

- Categories: