Promises, promises…

An Upcoming Election and the Threat of Tariffs[1]

One of the many promises we are hearing during this election is that tariffs will be levied against the Chinese, and that we will makes billions of dollar. When the Trump Administration tariffs were launched against Chinese imports, China quickly created an additional tier in the supply chain by shipping through middlemen in other countries. This strategy created a buffer against the tariffs, passed through costs, and made money both for China and the middlemen. During the same time, China has encouraged exports by cutting taxes on their exporter firms. Thus, the White House’s attempts over two presidencies to “derisk” trade with China, despite being the cornerstone of its foreign policy, is not working. However, the current Trump Administration has threatened to impost 60% tariffs on China, and 25%b on all imports.

U.S. officials have been particularly keen to limit imports of advanced manufacturing products from China. Between 2017 and 2022, the share of imports arriving from China did indeed decline by 14% while imports from more “friendly” countries—such as Vietnam, Taiwan, India, Thailand, and Malaysia—have grown. However, the share of Chinese imports into these countries is rising fast, as China is also establishing subsidiaries in these countries and shipping intermediate parts and components to and through these touch points. “Tariff-jumping,” or production within a friendlier environment, is a well-known phenomenon in global trade circles.

The reality, of course, is that we all pay the price of tariffs, which are passed on through consumer prices. China is very clever in findings ways to transship products however. The rerouting of shipments through countries that are U.S.-friendly has implications beyond changing trade routes. China has increased its share of exports to the ASEAN (Association of Southeast Asian Nations) bloc in 69 of 97 product categories. Likewise in Mexico, 40% of offshore investments in automotive manufacturing comes from China, and China is exporting more than twice as much volume to Mexico as it did five years ago. The newest tariffs proposed by the Biden Administration include tariffs on electric vehicles of 100%, those on steel and aluminum products of 25%, and a doubling of the rate on semiconductors to 50%. These moves will probably further encourage “friendshoring” activities by Chinese firms.

Prices and Inflation

The price consumers are paying for food is one of the most controversial issues during this election season. Both sides are making different claims. The Trump campaign claims that inflation has never been higher during the Biden/Harris Administration, and that the federal government is to blame for it. A second set of promises from the Harris campaign claims that big companies are “price gouging” consumers with high prices at the grocery store and ripping off consumers. It is true that inflation has been a problem, but as we have indicated in prior posts, price gouging is simply a function of increased supply chain inputs, not companies who are exploiting a situation.

y Jason Miller, (one of the country’s best government data analysts (in my opinion) Professor at Michigan State), conducted an analysis using a number of his charts from government sources, that provides a realistic and objective set of insights about the real state of inflation, price gouging, and the role of the government (if any) on these developments. Hopefully these facts will shed some light on a very emotional issue to date in the election campaign cycle.

US Economy Leaves other Countries “in the Dust”

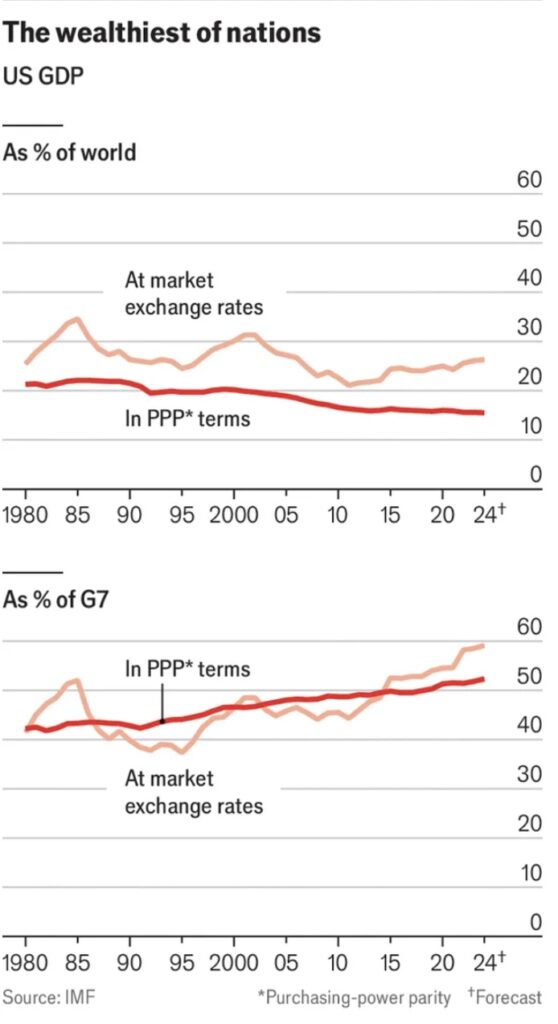

Another often repeated claim is that the US economy is in a terrible state, and has never been worse. Again, the data just doesn’t support this claim. Check out the latest cover story of the Economist, a journal that is one of the most objective and data-based that can be found. In their words, America’s economy has left other countries in the dust! The authors state that “America has grown faster than other big rich countries, and it has rebounded more strongly from bumps along the way. The faulty diagnosis of the competitiveness council back in 1992 should stand as a corrective for those now peddling gloom. America’s growth since then has been best-in-class, and its strengths today give grounds for optimism about the country’s economic power and potential. That America’s share of global GDP in PPP terms has decreased is less a comment on its own trajectory than on the growth spurts of the two most populous countries, China and India. China’s output per person remains less than a third of America’s; India’s is smaller still.” (See charts above).

Other data also point out that it isn’t just China and India. America is doing better than any of its Western peers as well. “In 1990 America accounted for about two-fifths of the overall GDP of the G7 group of advanced countries; today it is up to about half. On a per-person basis, American economic output is now about 40% higher than in western Europe and Canada, and 60% higher than in Japan—roughly twice as large as the gaps between them in 1990. Average wages in America’s poorest state, Mississippi, are higher than the averages in Britain, Canada and Germany.

And America’s outperformance has accelerated recently. Since the start of 2020, just before the covid-19 pandemic, America’s real growth has been 10%, three times the average for the rest of the G7 countries. Among the G20 group, which includes large emerging markets, America is the only one whose output and employment are above pre-pandemic expectations, according to the International Monetary Fund.

Hmmmm doesn’t sound too bad. Ironically almost 40% of the population believe we are in a recession! It is important for people to look around and be realistic about how well we are doing in the United States. It’s no surprise that so many people want to cross our borders…