Will Supply Chain Price Increases Result in Inflation? The Fed isn’t Worried…

As vaccination rates in the US, the UK, and Europe have risen, economies have shifted back and capital projects are beginning to resume. However, significant problems remain with respect to major shortages and price increases that exist in supply chains.

- Consumers are finding that everything from appliance parts, bicycles and other products are in short supply. Post-pandemic spending is booming, but consumers are discovering empty shelves in many retails for goods they’ve come to expect are readily available. The latest CPI increase announced on June 10 reflects a 5% increase from a year ago, the highest annual inflation rate in 13 years.

- Demand for labor is rising, but many jobs remain vacant, with a shortage of qualified applicants causing many companies to complain about on-going federal COVID relief checks, and impacting state unemployment rolls.

- Demand for agricultural commodities such as soy oil are reaching record highs, causing prices to spike for many goods including hobs, gasoline, diesel, crude oil, corn, copper, coffee, and others. Grocery manufacturers are seeing shortages and price hikes on wheat, corn, and many other commodities

- Rubber shortages will occur likely as a result of poor harvests, Chinese investor futures cornering the market, and a lack of investment on the part of Singapore bankers.

- Increased steel prices have added an average of $515 to the cost of an average US light vehicle, as have the cost of aluminum used in production products.

- Chinese operators are in some cases increased prices or halting operations, and are in some cases refusing additional orders due to capacity limitations due to higher raw material costs.

- Lumber prices have escalated, as lumber mills grew capacity by 10% but have failed to keep up with housing market growth.

- Semiconductor lead times have gone from several weeks to six months or more; automotive companies have been shut down due to lack of chips.

We get a lot of our products from China – and China’s producer price index (PPI) increased 9.0%, the National Bureau of Statistics (NBS) said on June 9, 2021, as prices bounced back from last year’s pandemic lows. This was the fastest one-year gain for any month since September 2008 and was driven by significant price increases in crude oil, iron ore and non-ferrous metals China’s May factory gate prices rose at their fastest annual pace in over 12 years due to surging commodity prices, highlighting global inflation pressures at a time when policymakers are trying to revitalize COVID-hit growth.

For the first time in the rail container volume index history, non-holiday empty containers outnumber the loaded container volumes heading into Los Angeles. This occurred briefly at the beginning of 2019 around New Year’s when the trade war with China was escalating. Empty international containers are controlled mainly by the maritime operators and can signal growth in import volumes. This one, however, may just illustrate how dire the situation really is.

What is more concerning is that this may not be the worst of it from a cost and supply chain bottleneck perspective. Maritime Market Expert Henry Byers has this to say about the surge of empties and what is signals for shippers and transportation providers moving forward:

“It’s time to sound the alarms. The shortage of container capacity is already affecting many supply chains, but almost no company will be spared from what lies ahead. The congestion and delays happening right now are primarily part of the downstream ripple effect that was largely caused by last year’s increased import volumes. Since we are able to see these volumes as they are leaving on vessels that are destined for the U.S., we can tell you that these TEU volumes are still hitting record highs. So, if the downstream supply chain is already under enormous pressure, we are likely to see rates reach new heights as well.”

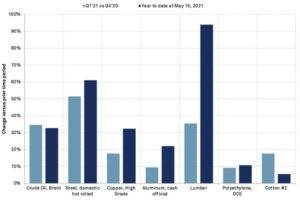

The chart from a recent webinar I was on with Tom Linton for the S&P Market Intelligence University Essentials series suggests significant cost increases across a number of different commodities. A number of critical increases include lumber up 94%, steel up 61%, copper up 32%, and the proportion of earnings calls hitting inflation keywords is up 7% year over year in Q1, and 55% year over year in April 2020. The rapid ramp-up in inflation is occurring suddenly in 2021, with increases in some areas like structural steel up 3% every week!

So with all of these price increases – are we going to see inflation this year? Unlikely.

The outlook for inflation and action by the Fed is, in fact, a “mixed bag”. Our interviews with executives who have sat in on recent Federal Reserve meetings in May report that there is unlikely to be a coordinated federal response to the current situation. Although inflation has been discussed at length in Fed Reserve meetings, the annualized year over year inflation for the United States has remained at 3.5 to 4% for Q1. Over the last ten years, inflation levels have been at 1.8 – 1.9% annually. The Fed’s mandate is simple – to have full employment, which is 5% or less, as well as maintain stable prices, which is typically around 2% year over year. The Fed’s position is that the data shows 4% inflation, and since they have averaged 1.8%, they are comfortable with keeping it at 4%, through 2022. Although the Fed also believes that price escalation for commodities and steel is unsustainable, they also believe that prices won’t likely collapse, but also are unlikely to continue to go up. As a result, when they average it all out, even though prices for steel, semiconductors, and commodities have escalated significantly in 2022, the inflation data will not pick up this price increase, so the Fed will remain not worried about inflation.

Although the media continues to emphasize the increase in consumer prices rising as companies pass on the costs of commodities, and everybody is feeling it in their daily lives (e.g. filling up your vehicle or eating at a restaurant), the Fed continues to take a position that the data does not warrant any concern. This is a very interesting way to look at the current problem. Their position is that their primary concern is getting people back to work. Today, too many low wage workers continue to receive unemployment checks. Until these unemployment checks run out, there won’t be any big shifts in the job numbers. This has become a “government funding” problem. If there continues to be unemployment funds, low wage individuals will not make as much sitting home, but can supplement their income with Uber driving and other supplementary income, and continue to maintain their life style. However, when the unemployment checks run out, these low wage earners will go back to work. (Today, you can’t drive by a fast food restaurant without seeing a Help Wanted sign!) This is not a high earner problem….

What will the future look like? If there is one defining insight I’d like to emphasize in this blog, is that no one can predict what is going to happen! In March of 2020, very few people were able to predict where we would be today. No one predicted that it would be a one quarter recession, with full recovery by Q4, and no one predicted the massive price escalations and shortages we are seeing in June 2021. However, given the lack of federal support for increasing interest rates, we are likely to see escalated prices through most of 2021, and likely well into Q1 and Q2 2022. We are seeing some capacity expansion in some sectors, but others are reluctant to invest in capacity, as they do not foresee whether this is a blip in time, and things will return to normal and utilization will drop back to normal levels again. Many believe that as fast as everything went into “supercharged” mode, the slow down could likewise be very quick, which would result in increased inventories and oversupply with lower demand. Other factors which could drag down growth include corporate tax increases from the Biden Administration, as well as the potential for a minimum global corporate tax which is being discussed by the G7. As government unemployment checks and COVID financial assistance begins to drop in Q3, we are likely to also see consumer spending drop, and credit card defaults from the increased spending we’ve seen this month begin to kick in, which will drop demand further. This would also lead to slow downs in housing, with increased inventories of homes and used cars, which would also lead to price drops.

So in the end – there really is no crystal ball. In the short term, learn to live with paying more for just about everything, knowing that it could change on short notice!

- Categories:

- Commodities forecasting

- Coronavirus Impact on Supply Chains

- COVID-19 Supply Chain View from the Field

- Director's Blog

- Emerging Issues in Supply Chain

- Oil and Gas Procurement

- Strategic Cost Management

- Supply Chain Finance

- Supply Chain From The Field

- Supply Chain Management>Forecasting

- Supply Chain Risk

- Tariffs