Supply chains remain wonky… and will continue that way for awhile (Jason Miller blog part 4)

I have been sitting in on interesting calls the past couple of days, and have also been exchanging emails with my colleague Jason Miller at Michigan State University, and also sat in on a presentation by Bill Villalon, recently retired President of APL Logistics, who presented to the CAPS Board. On top of the sanctions being announced by the Biden administration today on Russia, there are a lot of other crazy things going on in the logistics and supply chain sector, that are really driving the markets nuts… and people as well! The following are some interesting data that shows how crazy things are going. Predicting what is going to happen is anyone’s guess in this environment. Here’s a few reasons why.

Freight demand and rates are escalating

Freight rates are going crazy…and this is really hard to comprehend: the producer price index for all types of freight transportation arrangement (TL brokerage, LTL brokerage, intermodal marketing companies, ocean freight forwarders, air freight forwarders, etc.) are escalating, as shown in the chart below. Pooled together, prices had barely budged since 1997. Freight was completely flat… Until 2001, when they exploded upward. But that increase was nothing compared to what we are seeing today.. the Freight Transportation Arrangement firms are now receiving 45.7% more for their services than in January 2020.

Transpacific capacity will remain oversubscribed, and we will continue to see shortagers in virtually every handoff of product from Asian factories to US store shelves. This includes shortages of containers, chassis, vessels, as well as deficit in marine terminals, warehousing and rail capacity. This has created havoc – exponential rate increases in ocean freight and reliability rates in the low teens…

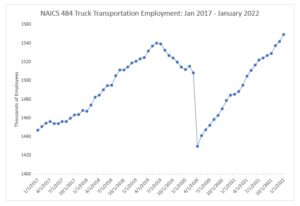

Employment in supply chain related industries is soaring. Warehousing has been the fastest growing sector of the economy for employment; January 2022 showed employment was up 59.3% since January 2018 (4-year comp). As rates for trucking are going up, not surprisingly so is pay – and this is leading to a significant rise in the employment numbers for trucking… The seasonally adjusted trucking employment data showed a very sharp recovery since the April 2020 plunge….funny how the market works like that!

Inventory is piling up in warehouses

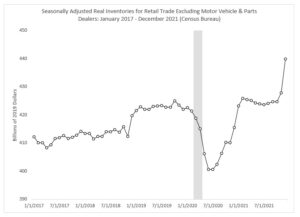

Retail ex auto inventories are an interesting situation. Seasonally adjusted, deflated inventories for retail (excluding automotive inventory) exploded upward in December. Executives I’ve spoken with emphasized how their warehouses are completely full of inventory. In some cases, this is because there are shortages of components, and products cannot be put into final assembly without all of the parts available, so this is boosting up inventory values as stuff accumulates waiting for parts. In other cases (e.g. healthcare), executives became so gunshy during COVID of running out again, that they are literally buying 180 days or more of PPE and supplies, and stuffing it into leased warehouses.

As warehouses are full, and DC’s are unable to process an unpredictable bunching of container arrivals, containers on chassis are becoming surrogate warehouses, and this has undermined the overall network and reduced its effective capacity.

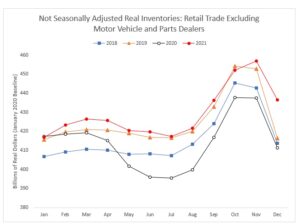

In most cases, inventories drop significantly after the beginning of the year, as demand goes down, and the Christmas rush passes. However, this year, the not seasonally adjusted inventories declined by only roughly half of what they normally would (see the not seasonally adjusted plot below). In particular, pay attention to the red 2021 line – which is nowhere near where it was in the past for 2018-2020. People are either hoarding inventory or are being forced to hold it.

E-commerce levels are subsiding..

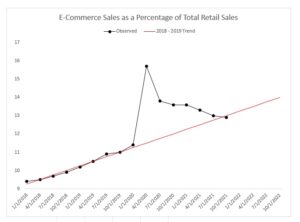

By the way, the Census Bureau dropped the Q4 2021 e-commerce supplement last week, and the key takeaway when we look at e-commerce for brick-and-mortar retailers was a strong return to in-store shopping. Some of the evidence is that:

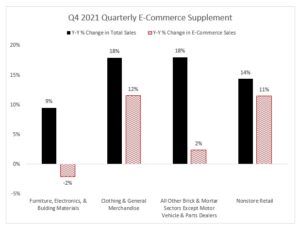

2]: Year-over-year growth in total sales and e-commerce sales for brick-and-mortar sectors demonstrate that the growth rate of total sales exceeded e-commerce sales, inherently implying in-store sales increased at a greater rate.

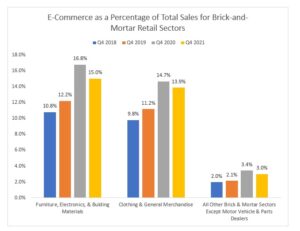

For brick-and-mortar sectors, e-commerce as a percentage of each sector’s total sales fell in Q4 2021 from Q4 2020. This further helps explain why the holiday package season went pretty smoothly.

Air freight is flying high…

Another crazy plot: inbound international air prices from Asia to the USA are up 103.8% since January 2020 based on BLS data released Wednesday. That plot says it all for how tight air freight capacity currently is. It is likely demand for air freight is up because the cost of sending it by air is likely appealing, given that cargo spot rates are near $9000 per container and leadtimes are extending to a month or more..