Recession ahead? One contrarian doesn’t think so…

I had the pleasure of hearing Professor Jason Miller from Michigan State University speak to the Center for Advanced Purchasing Studies members today, sharing with us a variety of fascinating charts and figures that he pulled from all of the publicly available data produced by the federal government – most of it is census data. Miller (a Spartan and also a Buckeye) mentioned he did not have much regard for the University of Michigan’s Consumer Sentiment Index, for a variety of reasons. After hearing Jason’s presentation of the economic data from a number of overlooked, publicly available, government sources, I agree with this sentiment. I don’t think a recession is ahead – but be ready for more shortages and more inflation…

Miller started out by opining that the U of M consumer sentiment index is an unreliable economic indicator for a number of reasons – but most of all because the sentiment data seems to be entrenched with people’s political affiliations – democrats were upset with Trump, and Republicans upset with Biden. Customer sentiment seems to vary too much on political issues – and what people DO is not always the same as what they SAY.

For instance, take retail data. Miller showed how retail sales are still running well ahead of pre-COVID spending. Specifically, we are 6.1%. above the trend line for retail spending – and we are still having record imports and buying a lot of stuff! The March 2021 stimulus led to massive spending – and although we are a bit down from that, we are still well above the long-term trend.

Unlike many economic pundits who are warning of a recession (not to mention the Wall Street analysts selling stocks when the Fed posts a rate increase), Miller does not believe we are anywhere NEAR a recession – thus making him a bit of a contrarian. Here are some legitimate data points to support the idea that a recession is not going to occur.

- Containerized imports are up 30% still from 2019. 2019 was down from 2018 but has increased along with the consumer spending. If we were in a recession – we would see this falling off.

- Tons of Air Freight is up 20% – based on the physical weight of products. We are not headed off a cliff.

- Manufacturing revenue with inflationary pressures – is at the highest ever since 2004 – but what does this mean for profits? Good news there as well – manufacturers’ profits are up 10% – meaning we are not yet seeing profits squeezed by inflation. Sectors with higher profits are oil and gas, and lower is transportation. Wood products have the biggest increase in profitability, as lumber prices have not increased as much. Primary metal products are higher, so are computers.

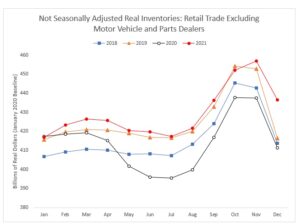

- In addition, manufacturers are holding on to a ton of cash – and are now sitting on about $850B in cash. But inventory is not up a lot more. In general what we see is automotive companies in particular are holding lots of inventory waiting for their chips to arrive, but in general are not seeing enough chronic issue to cause a massive concern. Many are actually running a little low!

- Industrial production output looks at physical units produced, which excludes computers and electronics. We see growth in 2017 and 2018 – and then COVID shuts it down – and then a quick recovery – a straight line up. In fact, June data actually went up – but didn’t increase when seasonally adjusted. If you only look at seasonally adjusted – you miss the whole picture. For instance, output increased 1.1% from May – but we expected 1.6 seasonally adjusted – a half point reduction –and economists saw this as a big deal. However, Jason pointed out that traditional seasonal cycles are not holding up since COVID – and we could see a gain in July, even though output drops -or vice versa.

- For make to order manufacturers- the gap between new orders and shipments is moving closely. New orders are outpacing shipments – which suggests that the backorders are likely increasing. The chip situation seems also to be doing better – as automotive sales are up.

- Non-seasonal manufacturing employment, which is the number of people working in establishments that are considered primarily in manufacturing activity, is up. The June 2022 reading shows we are back to the same peak employment levels we enjoyed in 2019 – meaning there are 12.8M people employed in real manufacturing jobs. In other words, we have seen employment levels rebound to where they were in 2019. But the rate of job openings is still at unprecedented levels compared to 2018, and the strength of the mfg. sector is such that many companies cannot find enough people! Also the job QUIT rate is up – pre-covid we were at 1.6 – and now at 2.6% – much higher..

- Quarterly survey of plant capacity utilization surveys answers to an interesting question: if you didn’t operate at full capacity – why didn’t you? One of the majorreasons is insufficient supply of labor – 45% of plants didn’t operate at full capacity because of insufficient labor! This would be a problem if there was a slowdown in demand – and given strength of demand – labor shortage issues may be responsible also for rising wage rates and also contribute to inflation.

- Speaking of Inflation – the price index for final demand products compared to June 2021 (e.g. the price manufacturers receive for final products, not intermediates) is up 18.4%. This represents tremendous inflationary pressure – and it is also evident that this will not slow down but will remain at this level over time. There is no evidence we will see a pooling of final demand for finished goods prices. Year over year increases for Stage 4 final demand finished goods captures the price of inputs for food manufacturers, motor vehicle assemblers, and machinery assemblers.

- While this measure of inflation is trending down – the rate of slowing suggests it will be many months of additional price increases being passed to finished goods companies. So expect many months for inflation – best case – 6 to 9 months of inflation going forward.

- Another source of inflation is primary metal manufacturers – manufacturers of steel, copper, foundries. This index is a weighted average of price increases. The index in January 2021 is 100- and and we are up 64% since January – and we may have reached a peak period in terms of pricing – but that is still 60% higher than 2021.

- Trucking is also seeing strong inflationary trends. Full Truckload has started cooling has dropped a little bit, but is still up about 25% YOY. Carriers are disciplined with pricing and getting unprofitable freight out of their network – so expect little price relief this year.

- Air freight prices in June are at 80% above 2019 (Asia) and 40-50% above 2019 for Europe. These too are not going down.

- Container spot prices went up to $12,000 in October 2021, but last week we were at about $7500. This is down from the peak in 2021, but remember when it was $1800 before COVID? It won’t be going back there any time soon. So where will it level off? Likely will go to $6000 and stabilize.

To summarize – we are not going into a recession, but you can still count on continued supply disruptions, on-going price increases, and on-going labor shortages. We are in a new world – one in which we need to let the data tell us what is going on, and not rely on prior economic theory, which has never seen conditions like this before..