NC State SCRC analytics contribute to KRMA, one of the top ESG funds in the market

More sustainability-minded investors are becoming conscious of what is known as ESG funds. Investments predicated upon Environmental, Social and Governance best practices evolved from what was once known as socially responsible investments. In its day, SRI was essentially a subtractive process. An investment universe such as the S&P 500 was combed to cull “vice” or “sin” stocks—companies engaged in the tobacco, booze, gaming or aerospace/defense industries—to create a portfolio. The practice ultimately led to chronic underperformance. It’s no wonder why. Often, the sin stocks were the ones that fared best in market cycles!

ESG-focused investment tends to be more proactive, purposefully seeking out those companies that follow best practices with regard to:

ESG-focused investment tends to be more proactive, purposefully seeking out those companies that follow best practices with regard to:

- Environmental performance related to pollution, climate change, recycling and the like;

- Social criteria impacting the company’s relationships with employees, suppliers, customers and communities in which they operate; and

- Governance with respect to company leadership, executive pay, internal controls and shareholder rights.

The Supply Chain Resource Cooperative has been engaged in its supplier relationship maturity model, which includes evaluation of Fortune 500 companies and their progress towards both a) environmentally conscious supplier management, and b) adherance to the UN International Labor Organization guidelines around human and labor rights in the supply chain. The latter is particularly important for companies who source in low cost countries, and this has been a major focus for our work over the summer as we partner with VF and Nike to assess their global supply chains. Prior work by NC State MBA students in a summer class I taught on environmentally-conscious supply chains has yielded substantial insights into who are truly leading companies in a number of different sectors.

In addition, work by PhD student Yung-Yun Huang has been utilized Machine-Based Learning algorithms to scan third party news feeds, assess corporate commitment to sustainable supply chain principles, and evaluated the entire set of Fortune 500 companies on their progress towards truly sustainable supply chains. Two of these indices, which are updated every year, were used as input into the 37 data inputs used in the Wall Street Journal’s inaugural “Management Top 250” ranking of companies, published recently, and highlighted in this blog.

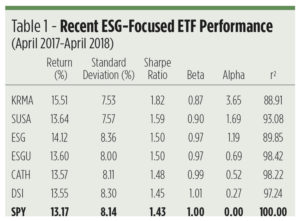

The SCRC supply maturity ratings have also been used for many years by Rick Frazier, head of Concinnity Advisors, LP, that leads the Global X Conscious Companies ETF (KRMA). This fund was recently highlighted as one of the top performing funds by Wealth Management in its review of ESG funds. This fund plays up the “S” and the “G” in ESG by focusing on companies dedicated to providing positive outcomes for five key stakeholders: customers, suppliers, stock and debt holders, local communities, and employees. To qualify for inclusion in the KRMA portfolio, companies must have a three-year track record of exhibiting positive social and corporate governance characteristics as reflected by their employee productivity, executive integrity, customer loyalty and the quality of their financial reporting, among other metrics. By limiting its investment universe to U.S. companies with market capitalizations of $2 billion and more, KRMA’s 140-stock portfolio has a definite large-cap tilt. KRMA now boasts a 6.10 ESG Fund Quality Score.

The SCRC supply maturity ratings have also been used for many years by Rick Frazier, head of Concinnity Advisors, LP, that leads the Global X Conscious Companies ETF (KRMA). This fund was recently highlighted as one of the top performing funds by Wealth Management in its review of ESG funds. This fund plays up the “S” and the “G” in ESG by focusing on companies dedicated to providing positive outcomes for five key stakeholders: customers, suppliers, stock and debt holders, local communities, and employees. To qualify for inclusion in the KRMA portfolio, companies must have a three-year track record of exhibiting positive social and corporate governance characteristics as reflected by their employee productivity, executive integrity, customer loyalty and the quality of their financial reporting, among other metrics. By limiting its investment universe to U.S. companies with market capitalizations of $2 billion and more, KRMA’s 140-stock portfolio has a definite large-cap tilt. KRMA now boasts a 6.10 ESG Fund Quality Score.

We are proud of Yung-Yun’s accomplishments in creating this unique index, and are thrilled that KRMA is performing so well in the market. Kudos!

Portfolio evaluation notes:

At the top of the table is KRMA, which earned a significant premium over the market while providing holders a relatively smooth ride. The fund’s equal weighting scheme contributed greatly to KRMA’s outperformance, allowing the impressive gains from tech stalwarts such as Texas Instruments and Automatic Data Processing, financial firms like T. Rowe Price, and drugmakers epitomized by AbbVie, to drive returns. KRMA truly marches to its own drumbeat. Its r-squared and beta coefficients are the lowest of all the ETFs, putting considerable daylight between the Global X portfolio and the SPY market proxy. KRMA’s 3.65 alpha coefficient is also impressive, engendered in part by the portfolio’s relatively low volatility.”