Supply Chain Pressure Index is up for Q4 2021 – and will likely stay there (Jason MIller Blog #5)

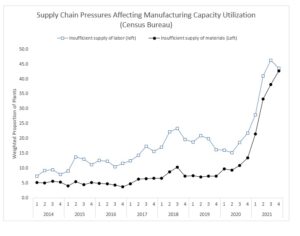

Yesterday the Census Bureau released the Q4 2021 Quarterly Survey of Plant Capacity Utilization, and my colleague Jason Miller was able to update the MSU Supply Chain Pressure Index. The reading jumped to 494.6, up from 436.6 in Q3 2021 (13.3%). This indicates that in Q4, plants continued to experience significantly lower capacity, due to increased shortages of material, labor shortages and transportation/logistics constraints.

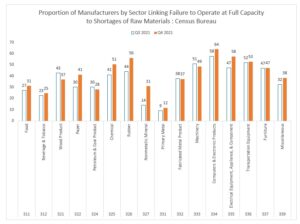

Looking at material shortages by sector, it is interesting to note that most sectors reported either unchanged or slightly worse shortages in Q4 2021 relative to Q3 2021. The increases that really stood out to were chemicals, rubber, and electrical equipment. It is no surprise that these commodities are essential to not only automotive, but many other industrial products and consumer products, including appliances, motors, and power equipment, which explains why it is so difficult to purchase these items and many are on back order.

One thing that is somewhat interesting was that, while insufficient supply of material issues were worse that Q32021, there was a slight downtick in the insufficient supply of labor shortages, for not operating at full capacity. This may be simply a “blip”, or it could be downward trend, suggesting that more people are going back to work. However, recent reports suggest that there are still almost 11 million open jobs on the market, and not enough workers to fill these jobs, and that the unemployment rate fell below 49ers %.

These results suggest that shortages will continue. The Russian invasion of the Ukraine will no doubt render these shortages even worse.