Relational Contracts Student Insight: Codifying the Deal is Key!

In Part 2 of our blog series leading up to the SCRC meeting this coming Thursday on “Relational Contracting”, we feature a white paper developed by Tracy Burnett, a second year MBA in our online program. Tracy here discusses some of the overlapping issues that occur when ERP systems meet contracting processes…. and how to resolve them.

With the increasing capabilities of technology, the Supply Chain functions have a myriad of 3rd party software, each with varying levels of configuration and customization, to choose from. The category management process may be streamlined for maximum impact with the use of the right technologies. While all 7 steps are important, the Contracting phase, outlined below, codifies the agreement between supplier and buyer. Some headway has been made to streamline the contracting process with technological advances. However, a holistic and streamlined approach, encompassing all 7 steps in the category management process, is yet to be seen.

Figure 1: Category Management Process – 7 Step sourcing process

Figure 2: Stages of Contract Management

Efforts are being made, with the help of technology, to move processes out of silos and into a holistic, cyclical view, much more representative of best practices and successful supplier management that doesn’t start and end, but lends itself to a supplier lifecycle, as IBM demonstrates with its Emptoris offering below.

Current State

To ERP or to Stand Alone

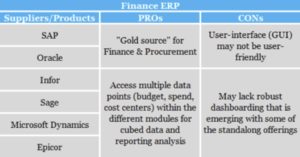

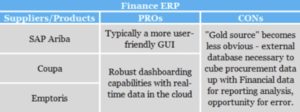

At the foundational level, contracting practitioners have the option of aligning with Finance and utilizing the firm’s Enterprise Resource Planning, ERP, system, or electing for a stand-alone option. Common and top-rated ERP systems include SAP, Oracle, Infor, Sage, Microsoft Dynamics, and Epicor. (Beroe 2017). Stand-alone options, now typically cloud-based, include SAP’s Ariba, Coupa, and IBM’s Emptoris as market leaders. The matrix below outlines the pros and cons of selecting a supply chain platform based on the Financial ERP system.

Interestingly, the PROs of a Finance ERP system typically turn into CONs when looking at a stand-alone offering. Proponents of electing for a stand-alone offering often point to a concept known as “best of breed”. The ethos is that these additional robust capabilities are needed, and cannot be performed with a traditional Enterprise Financial ERP.

Whether you elect for best of breed or a stand-alone offering, the decisions for technology purchases are not over. Today’s ERP has not been transformed to accommodate some of the niche technologies that have emerged. The contracting process is one in which we can see which technological advances are available in the marketplace today, but not available (or optimal) in the traditional ERP offering.

Define Negotiations Team & Roles

While this first step may seem administrative in nature, it’s as strategic as any of the others. Understanding who is tasked with keeping meeting minutes all the way to the chief negotiator is important to stay aligned and remain a united front when negotiating with a supplier. Simply spending time up front with the negotiation team to understand these roles is a start. Diving deeper to ensure you have the right people in the right roles, is paramount. For example, if we were negotiating with a Saudi Arabian oil company, we may want to ensure the lead negotiator is a man, to account for the cultural sensitivity. All of the procurement software offerings can accommodate defining team names and roles, typically with minor customization. Out-of-the-box project management tools, like Asana, could also be utilized to document these decisions. The important thing is that this step is well thought through, with sufficient resources to support the negotiation to closure.

Document Negotiation Strategy

In conducting a fact-based negotiation, data is your best friend. When coming to the table of a negotiation, the team must be prepared with all of the internal data available, as well as external market data. Simply demanding a supplier reduce their prices is a thing of the past, if it ever was a thing. Now, facts and data lead the charge. Armed with a myriad of data, volumes, spending amount, forecasts, the team will be best prepared to ask for what they need from the supplier. Further informed by market data, the team can understand what is possible and available in the market, without having to rely solely on what the supplier is stating.

Technology such as your ERP and/or procurement module can be mined for applicable, relevant spending and volumetric data to support the negotiation process. Similarly, any of these may be utilized to document the preferred approach as well as the best alternative to a negotiated agreement. IACCM journals propose a handful of AI technologies that have emerged to assist in this important step: Kira Systems, LegalSifter, Seal, and Leverton. Once implemented, these tools can mine unstructured contract metadata from systems to form a cohesive picture of the overall relationship between the buyer and targeted supplier. An IACCM journal contributor cites the success of one organization utilizing AI to organize and understand their contract data. The platform automatically clustered contracts into logical groups, extracts specific data points necessary for management review, and reduced man hours from 800 to 40 hours which included the tool’s configuration, processing, and data outputs.

Finally, each firm typically would like to begin negotiations on their respective “paper”. The contracting process is streamlined if your firm uses standardized templates for the various types of relationships: Master Service Provider (MSP), Master Application Service Provider (MASP), Master Outsourcing Service Administrator (MOSA) to name a few. Before sharing any template to begin negotiations, avoid a common pitfall by ensuring all of the template language is necessary, as well as relevant to the firm and location of services being performed. A common pitfall is to assume the terms in one market are the same as in another.

Plan and Conduct Negotiations

As the team works through the contract negotiation, there will be several redlines on each side to tackle. Through this process, terms are accepted and rejected, until both sides have come to an agreement. With all of these edits, it’s important to perform additional checks on the document to ensure important provisions were maintained, as well as to ensure contracts are not hiding obligations or other legal exposures. LawGeex, ThoughtRiver, and Contract Room are a few software technologies that can reduce this administrative burden. Of course, like any other robotics, the department must determine thresholds and approved language deviations in order to program the software. IACCM journal contributor Peter Wallqvist describes just this type of technology saving financial institutions time and money today for risk management activities.

Select Supplier for Award & Document Benefit

After the contract has been fully negotiated and both supplier and buyer are comfortable with the terms and conditions of the agreement, it’s time to execute. Work flow and signature tools like Docusign or SignNow are readily available in the market to assist with obtaining e-signatures. All of this occurs outside of the ERP platform, so additional steps are necessary to document the deal. ERPs have fields available for capturing key financial metadata like contract start and end date, total contract amount, and discounted payment terms to name a few.

Future State

While technological advances have been made with the various software solutions to manage all or a portion of category management, the missing link is just that. The link. Practitioners who elect for the best of breed approach with fragmented solutions will likely never have a streamlined process from end to end. We use this tool for that, and that tool for this, and this other tool to try to collate the data together in an effort to provide valuable insights and analytics. Layering the technologies on top of one another creates a scenario without a gold source.

Since the Dodd-Frank act and SOX reporting mandates, Finance must trust their ERP systems for financial reporting more than ever. What about all of the other data generated from a procurement system or a contract system? Are you confident that all of the systems are working together, feeding each other properly, and all of the man-made ties and connections are still intact? In today’s cloud-based platforms, one update here may cause a break over there. How do you avoid this? Utopia is a single ERP system for everyone to utilize, and for Finance to have confidence within. Many of the “best of breed” or other add-on tools that we discussed are nice to have, but not a requirement. Requirements are sound workflows and trusted data, from a single gold source. If users require a bit more training to understand how to work with the ERP, then invest it. If other users demand customization, resist them. Over-engineering in the ERP environment leads to customization that must be supported. With updates constantly being made for a cloud solution, your customizations must also be updated. Don’t get yourself or your IT department in this vicious cycle of break-fix. Allow your platform to be flexible enough to get the job done, whatever it may be, without compromising the integrity of its longevity.

In breaking down each step of a contractual negotiation, we’ve identified multiple stand-alone software solutions to enhance the process. The challenge to truly transform end-to-end is to integrate these singular technologies seamlessly into the existing ERP solution. The fact that they exist, means that this is feasible, it is just yet to be seen in the marketplace.

Supplier Management – Continuous Improvement

Aside from quality, trusted data, and a smooth process for everyone involved with the ERP, capturing all of these activities in an end-to-end solution could unlock additional value. In thinking holistically about how category management works, it’s not optimal through disparate work streams and tools in silos. It is more like a cycle, with phases beginning and ending, feeding into one another. Capturing consistent data in one tool will allow for ongoing monitoring of supplier performance, and give stakeholder’s confidence that they are measuring and reporting accurate data. If a supplier’s performance is declining, and the tool captures this information in a timely manner, they may be coached to bring the performance up. Conversely, if the performance doesn’t improve to reasonable standards, everyone in the company will have access to that information, and likely won’t continue to pursue the supplier for additional work.

In this information age, data drives strategy, negotiations, and decision-making. Just having the data is not good enough. Creating analytics and finding insights in the data is the task at hand. Managing the influx of big data will be fundamental to any firm’s success. Do your firm a favor and up-fit your supply chain activities to be consistent with this cyclical, holistic approach.