Inflation is Here for Awhile… Let’s Start to Manage It!

I concluded the last of the three-part series with my good friend Tim Cummins from World Commerce and Contracting today on inflation, and the implications for contract management and supplier relationships.

On Day 1, we discussed the current state of inflation, and what we are seeing. In general, inflation is something that everyone grumbles about, as no one likes to pay more money for anything! In particular, fuel and food prices have been on everyone’s list of issues, but this extends to a much broader set of categories. In particular, it is unusual in that material costs, labor costs, and transportation costs have all gone up, which is leaving producers with few options to avoid passing on those costs to consumers. To address these increases will require individuals to think differently about how they run bids, how they negotiate with suppliers, and how they structure contracts. In particular, in the current environment it is more important than ever to have regular communication with the 20% of suppliers that make up 80% of your spend. Contracts can be tied to indices that are representative of what is happening in market, and should be updated up or down at least on a quarterly basis, due to the extreme volatility of many markets. In addition, putting collars on prices can trigger a renegotiation if there is extreme movement one way or the other in markets.

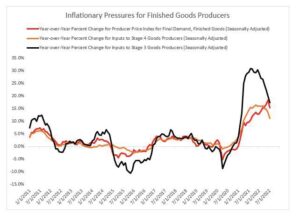

On Day 2, we examined inflation forecasts. In particular, we reviewed some charts created by Jason Miller, who provided some excellent insights into where inflation is headed.

As shown in the chart below, Miller notes that the PPI for final demand finished goods (red), appears to have peaked on a year over year (YoY) basis as of June 2022 and is now trending down on the YoY comparison, but still up ~15% YoY. The projection is that it will take at least a year to return to 2018 levels. The input price index for finished goods producers (termed “Stage 4 by BLS) showed the YoY peak occurred about 4-5 months ago and is now trending down. the projection is that it will take another 6 months or so to get back to 2018 YoY readings. The input price index for Tier 1 suppliers of those finished goods manufacturers (termed stage 3) showed the YoY peak was in late 2021 and is trending down, albeit at a slower rate than it went up at! An optimistic scenario says that in 6 months we will see YoY changes back to 2018 levels. In other words, we inflation is starting to go down… slowly.

On Day 3, we examined what contract managers can do to manage inflation. As we noted on day 1, the number one issue is to establish a regular dialogue with suppliers on what they are seeing in markets, and establish a fair and unbiased approach for integrating price increases and decreases in the market into the contract pricing. These approaches may also require procurement people to educate their peers in marketing and sales, and let them know that the prices increases can either be absorbed in margins or must be passed on to customers, as they are unavoidable, and pushing back on suppliers is unlikely to be successful. In many industries, the power dynamic has shifted to suppliers, who are now seeing excessive demand for their products, capacity constraints, and are experiencing their own challenges with obtaining raw materials. For service contracts, it is also advisable to consult labor indexes that can gauge what is happening in labor markets. In particular, skilled labor like welding and CNC operators are in high demand, and engineering and programmer wages are up significantly, which is shifting the curve on many services. It is advisable to conduct some research on cost models that can establish the breakdown of labor, materials, and transportation costs. And also don’t forget that energy costs are up 17% this year, which will often lead to increased overhead rates as well!

Overall, we expect inflation to continue for some time. We need to adapt innovative contracting methods and build trust with suppliers, that will lead to greater transparency into costs, and collaborative approaches for fighting it.